HomeStart Glossary

Welcome to the HomeStart Real Estate & Mortgage Interactive Glossary.

Created from the minds of some of the most knowledgeable and talented people in the mortgage and real estate industries,

this interactive glossary is the most comprehensive, most current and most accurate glossaries in the nation.

This glossary is constantly updated following every federal guideline version release, mortagee letter,

technology change, and federal or state educational or legislation change.

The HomeStart Real Estate & Mortgage Interactive Glossary allows clients to understand any and all terms

used during their mortgage and/or real estate transaction(s), as well as the processing, closing

and funding of their home loans. This glossary contains HomeStart’s proprietary information, so

it should not be disseminated. This glossary below is alphabetized for the reader’s convenience.

How is it “interactive”?

The HomeStart Real Estate & Mortgage Interactive Glossary allows the reader (while

within the definition of a term or concept), to click on an unknown word within that

definition, jump to that word’s definition, read it and jump back

to continue reading the definition of the initial term or concept.

Soon, the reader will also be a viewer or listener, with embedded video

and audio content that explains a term or concept.

Interactive Real Estate & Mortgage Glossary

Copyright © HomeStart (DreamLoan, LLC) 2011-2024, All rights reserved.

$/#

$100 DOWN PAYMENT PURCHASE

A $100 Down Payment Purchase loan program (FHA loan) is available when someone is Purchasing a HUD-Repo and HUD has approved the Borrower (on the written Contract) to use $100 Down Payment Purchase financing. This loan program allows for almost a 100% loan (less $100) and the Seller, which is HUD, can still make Seller Concessions toward the Buyer’s Closing Costs. $100 Down Payment Purchase loans must be FHA 203B loans.

Related terms: HUD, HUD Repo.

1031 EXCHANGE

Tax deferred movement of Investment Property sale Proceeds into new a Investment Property or properties. 1031 Exchanges must be set-up using a 1031 Exchange Intermediary (usually a CPA) before the Investment Property sale (from which the sales Proceeds come) is completed. See the HomeStart Specialty Tutorials, “1031 Exchange”, “Properly Buying Investment Property,” and “Buying Multifamily Property - Becoming a Landlord in One Easy Step”.

Related terms: Investment Property, Rental Property, Non-Owner Occupied Property.

1031 EXCHANGE INTERMEDIARY

Tax professional who handles 1031 Exchange transactions for Sellers who wish to move sale Proceeds into another Investment Property or properties to temporarily avoid taxation of the proceeds. See the HomeStart Specialty Tutorials, “1031 Exchange”, “Properly Buying Investment Property”, and “Buying Multifamily Property - Becoming a Landlord in One Easy Step”.

Related terms: 1031 Exchange. Related terms: 1031 Exchange, Investment Property, Rental Property, Non-Owner Occupied Property.

1040

Personal tax form. The 1040 is a two-page form which is always the first two pages of the personal Income Tax Return and is a summary of all the Schedules, as well as a calculation of the tax due or the tax refund. The person filing must sign and date the second page of this form when submitting the return to the IRS.

Related terms: Income Tax Return, Income, Gross Income, Net Income, Qualifying Income, Analyzing Income.

1098

Interest Paid Tax form. This is the form that is mailed to the homeowner at the beginning of every year to show the Mortgage Interest paid on a loan in the prior year. This Mortgage Interest is tax deductible on Primary Residences and Second Homes from an aggregate loan amount(s) of up to $1 million. See the HomeStart Specialty Tutorial, “Tax Advantage Mortgaging”.

Related terms: Primary Residence, Second Home, Tax Advantage Mortgaging, Interest.

1099

Income Received tax form. This form is for independent contractors or Self-Employed individuals that do not have taxes withheld from his/her paychecks.

Related terms: Self-Employed, Analyzing Income, Gross Income.

203B

Normal (non-construction) FHA Purchase or FHA Refinance.

203K

FHA construction or rehabilitation loan (Purchase or Refinance).

2-1 BUYDOWN

FHA loan product. This product requires two additional Discount Points to be charged on the Front of the loan to permit the Borrower to have an Interest Rate two percent lower than the Rate sold for the first year, one percent lower than the Rate sold for the second year and equal to the Rate sold for the remainder of the loan’s term. For example, an FHA loan of $200,000 would have an additional $4,000 in Discount Points added to the Settlement Statement. If the Rate sold for this loan and this Borrower is 5.00%, then the Rate would be 3.00% for the first year, 4.00% for the second year and 5.00% for every year after that on a fixed Rate Mortgage. 2-1 Buydowns exist usually on FHA Purchase loans because Seller Concessions toward Closing Costs can be up to six percent of the Purchase Price. This would allow the Seller to pay for all Closing Costs, including the two additional Discount Points added in exchange for the 2-1 Buydown. 2-1 Buydowns are very popular among Tract Builder-owned Mortgage companies because the Tract Builder is trying to make the New Home appear artificially inexpensive as a monthly payment.

Related terms: Tract Builder, FHA, Discount, Points, New Home.

3PLEX

A three-family property. See the HomeStart Specialty Tutorial, “Buying Multifamily Housing - Becoming a Landlord in One Easy Step”.

Related terms: Single Family Residence, Duplex, Triplex, Fourplex

4000.1

Mortgage term for the FHA Handbook.

Related terms: FHA.

401K

Tax deferred savings plan established for employees by an employer and administered usually by a third party agent. In Mortgaging, only 60% of the vested dollar amount of the 401K can be used as a Liquid Asset. This is meant to mimic reality, in that if a 401K were cashed out, there would be taxes and penalties equal to approximately 40% of the vested value.

Related terms: 401K Loan, Liquid Assets.

401K LOAN

Loan taken out against the vested portion of a 401K (See 401K for Vested Balance). The greatest benefit of a 401K Loan is that the Interest that is paid on the loan is paid back into the 401K account itself, thus it is a loan from the Borrower to the Borrower, with Interest. When any Conventional or Government Mortgage loan is underwritten, the payments on a 401K Loan do not count in the Back Ratio of the Borrower who borrowered the 401K Loan. This fact (that the loan payments are not included in the Back Ratio) can be used to the Borrower’s advantage. Say, for example, the Borrower has a large number of debts and cannot qualify for a new Mortgage loan because his/her debts are too high for his/her Income. In this situation, the Borrower could take out a 401K loan (if they have 401K holdings) and pay off the debts that are preventing Mortgage loan Approval. This would literally change the debt from debt which affects the Back Ratio to debt that does not, while still having the Borrower owing the same amount of money.

Related terms: Back Ratio, 401K, Liquid Assets, Income.

4506-C

IRS tax form that allows a third party (not the IRS and not the consumer) to directly obtain transcripts of the data the IRS possesses for an individual, a couple or a business for a specified number of years. Usually the data requested are Income Taxes, but can also include the W2s, K-1s or any other form that the entity filed with the Federal Government. This form is also used for audits to be run by entities purchasing a loan from another Lender. This form does not give the third party rights to transcripts in perpetuity and only lasts for 120 days. The 4506-C used for mortgaging is signed both at loan application and closing. The 4506-C is signed at Loan Application so that the income on the income tax returns provided to the originator can be compared to the transcripts of the income tax returns on file with the IRS as an anti-fraud measure and a verification method. This is done because some borrowers will use one set of income tax returns to qualify for the mortgage loan and then will immediately amend those same income tax returns in order to lower their income and pay less tax. This is a crime. Even worse, some borrowers will supply the originator with income tax returns that were never filed or that contain data that were never filed. This is also an even greater crime.

Related terms: Income, Income Tax Return, Loan Application, Closing.

4PLEX

A four-family property. See the HomeStart Specialty Tutorial, “Buying Multifamily Housing - Becoming a Landlord in One Easy Step”.

80-10-10

Combo Loan (First Mortgage and Second Mortgage) where the Combined Loan To Value does not exceed 90%. An 80-10-10 usually consists of an 80% First Mortgage and a 10% Second Mortgage, with another 10% either as existing Equity (on a Refinance) or the Down Payment (on a Purchase). See the HomeStart Specialty Tutorials, “How and Why To Do a Combo Loan” and on of the six called, “Tailor the Mortgage Yourself and Save Thousands - ”.

Related terms: Combo Loan, First Mortgage, Second Mortgage, PMI, MI, Loan To Value, Combined Loan To Value.

80-15-5

Combo Loan (First Mortgage and Second Mortgage) where the Combined Loan To Value does not exceed 95%. An 80-15-5 usually consists of an 80% First Mortgage and a 15% Second Mortgage, with another 5% either as existing Equity (on a Refinance) or the Down Payment (on a Purchase). See the HomeStart Specialty Tutorials, “How and Why To Do a Combo Loan” and one of the six called, “Tailor the Mortgage Yourself and Save Thousands - ”.

Related terms: Combo Loan, First Mortgage, Second Mortgage, MI, Loan To Value, Combined Loan To Value.

80-20

Combo Loan (First Mortgage and Second Mortgage) where the Combined Loan To Value does not exceed 100%. An 80-20 usually consists of an 80% First Mortgage and a 20% Second Mortgage requiring no Down Payment (on a Purchase) or Equity (on a Refinance). See the HomeStart Specialty Tutorials, “How and Why To Do a Combo Loan” and one of the six called, “Tailor the Mortgage Yourself and Save Thousands - ”.

Related terms: Combo Loan, First Mortgage, Second Mortgage, PMI, MI, Loan To Value, Combined Loan To Value.

A

A- (A MINUS)

“Just Missed” area of Prime lending that allows for loans with “outside of preferred” credit or ratio profiles. A- loans can be Prime loans provided they receive an Expanded Approval level offering on Desktop Underwriter or an A-offering on Loan Product Advisor. These loans have slightly higher Interest Rates than regular Prime loans.

Related terms: Expanded, Expanded Approval, Fannie Mae, Desktop Underwriter, Freddie Mac, Prime, Loan Product Advisor.

ACCELERATION

When a loan becomes Due And Payable sooner than its Term due to non-payment or a violation of the Deed Of Trust or the Security Instrument. Acceleration is the same as “Calling the Note”. Accelleration (in the event of Default) is the Lender’s right, resulting from the written documents that were executed by the Borrower when he/she received the Mortgage. The majority of the time, Acceleration takes place due to a Default for non-payment of Mortgage Payments.

Related terms: Calling the Note, Default.

ACREAGE

Property not within a subdivision, defined by Metes & Bounds measurements. Usually rural properties and large tracts of unsubdivided land have these Legal Descriptions; however, some older parcels of land that appear to be subdivided properties can still be Metes & Bounds. Metes & Bounds are used to describe a tract of land using Due North as the “key” and using directions, degrees and distances to create boundaries defining the land. The boundaries are described using a point of beginning and working around the parcel of land in sequence then returning back to the point of beginning.

Related Terms: Subdivision, Survey, Metes & Bounds.

ACTUAL RATE

The Actual Rate on a Mortgage is the actual cost of the money being borrowed. This is not the same as the Interest Rate or the APR on the Mortgage. Instead, it is the Rate that is the result of considering the actual cash saved on your Income Taxes due to the tax deductability of Mortgage Interest. For more information on Actual Rate, see the HomeStart Specialty Tutorial, “Equity Investing”. For more information on Mortgage tax strategies, see the HomeStart Specialty Tutorial, “Tax Advantage Mortgaging”.

Related terms: Interest, Rate, Mortgage Tax Deduction.

ADJUSTABLE RATE MORTGAGE

A Mortgage with a Rate that changes over time. The acronym for this term is ARM. ARMs come in many different varieties, but most of them (with the exception of a 1 month ARM) have a period at the beginning of the Mortgage where the Rate is fixed (the Fixed Period). At the end of the Fixed Period, the Rate will adjust up or down, based on the market at that time according to the Period. These are the terms referred to in, for example, a 5/1 ARM has a Fixed Period of five years and a change Period of one year.

The amount by which the Interest Rate can adjust up or down is based on the Cap and the Floor respectively. In order to fully assess an ARM, you would need to know the Initial Rate, the Fixed Period, the Index upon which the ARM is based, the Period of adjustments, the Margin, the Initial Cap, the Periodic Cap, the Lifetime Cap and the Floor. All HomeStart-certifed Brokers and Bankers are able to teach this to their HomeStart clients.

Once the Borrower understands these terms, the Borrower can acticipate the Rate and payment that his/her ARM will adjust to. An adjustment to the Rate is calculated by the Index plus the Margin that is then compared to the current Rate plus the Cap (the new Rate would be the lower of the two) which is then compared to the Floor (the new Rate would then be the higher of the two). For example, a 5/1 T-Bill ARM has an Initial Rate of 6.000%, a Margin of 3.000% and a Floor of 3.000% with 2/6/6 Caps (Initial, Periodic and Lifetime). If, after the five year Fixed Period is over, the T-Bill Index is 2.500%, this would be added to the Margin (3.000%) which is 5.500%. Then, as compared to the Initial Rate (6.000%) plus the 2.000% Initial Cap (total of 8.00%), the 5.500% is lower (if higher then the 8.000% would stand). The 5.500% is then compared to the Floor of 3%. 5.500% is higher than the Floor (if lower, then the Floor would stand). Thus the new rate for the next year (the Period) would be 5.500%.

Related terms: Fixed Rate, Period, Index, Margin, Floor, Periodic Cap, Initial Cap, Lifetime Cap, Rate.

ADJUSTED ORIGINATION CHARGE

Origination Charge minus the Yield Spread Premium being made off of the Interest Rate sold to the Borrower. This allows the Borrower to “see” how much the Broker is making off of the Interest Rate sold, because the number exists by subtracting the Adjusted Origination Charge from the Origination Charge.

When the Mortgage professional originating the loan is a Wholesale or Retail Banker (using his/her own funds to make the loan), the law states that Yield Spread Premium does not have to be disclosed. In this case, the Adjusted Origination Charge and the Origination Charge would have the same value.

When Borrowers see this situation, they should demand to know how much Yield Spread Premium (in dollars) that the Wholesale or Retail Banker is making off of the Interest Rate of the loan. It is possible that they charged the Borrower too much, and signing the loan documents at the Closing is the Borrower’s last opportunity to negotiate a deal.

Related terms: Origination, Discount, Yield Spread Premium, Back, Service Release Premium, HUD-1 Settlement Statement (antiquated form, now only used for Reverse Mortgages).

ADJUSTMENT

An addition or a subtraction to the value of a Sales Comp in order to make the property more “similar” to the Subject Property being Appraised. For example, if the Subject Property is 3,400 square feet of heated and cooled living space and one of the Sales Comps is 3,100 square feet, the Appraiser will give the Sales Comp a positive Adjustment (an addition) to the value for which it sold. This is so that the Sales Comp can be valued as if it too had 3,400 square feet of living space. Thus, the Appraiser takes the sales price of the Sales Comp and increases the sales price as if the Sales Comp sold with 3,400 square feet in order to estimate the value of another house with the same square footage - the Subject Property.

Adjustment can also mean the time when an ARM adjusts to its new Rate. For example, you might say, “In its first Adjustment, my ARM went down one percent, but at the second Adjustment, the Rate rose two percent.”

Related terms: ARM, Period, Initial Cap, Lifetime Cap, Periodic Cap, Index, Margin, Appraiser, Appraisal.

AGENCY

Area of lending. This area is for good and excellent credit Borrowers that covers both Conforming and Jumbo Conventional loans. Agency is also the Interest Rate at which member banks borrow money from the Federal Reserve.

Related terms: Conforming, Jumbo, Conventional.

AGENT

Realtor® or the party appointed in a Power Of Attorney document.

Related terms: Realtor®, Power Of Attorney, Attorney in Fact, Specific Power Of Attorney.

AGGREGATE ADJUSTMENT

Adjustment (credit) to Escrow Reserves collected at Closing when establishing an Escrow/Impounds account. Under the law, the Lender can only hold so much of the Borrower’s Prepaid funds (for Property Tax and Homeowner’s Insurance Reserves) before a limitation is hit. The Aggregate Adjustment brings the amount collected for Escrow Reserves down to the maximum (or limit) of what the Lender may hold. See the HomeStart Specialty Tutorial, “Pros and Cons of Waiving Escrows”.

Related terms: Closing Disclosure, Property Taxes, Homeowner’s Insurance, Escrows, Impounds.

ALL BILLS PAID AFFIDAVIT

Affidavit where the Builder assumes responsibility for any construction-related liens that may appear on Title after construction. An All Bills Paid Affidavit is signed by the Builder before the Builder receives his/her Final Draw so that the Builder assumes all responsibility for all debts owing to all Subcontractors who have worked on the constuction of the Subject Property. This affidavit is a powerful tool for the Borrower to protect him/herself should a Subcontractor lien show up on Title someday. The affidavit is enough to get the lien removed to clear Title. Whether a construction project is self-financed or financed through a Lender, an All Bills Paid Affidavit should be executed at the end of construction before the Builder gets his/her final draw. See the HomeStart Specialty Tutorial, “How to Do a Construction Project”.

Related terms: Custom Builder, Construction Loan, Draw, Final Draw.

ALTERNATIVE CREDIT

The placement of credit histories from non-traditional creditors on a Borrower’s Credit Report. This is part of Credit Development. See the HomeStart Specialty Tutorials, “How to Instantly Build Credit When You Have None”, “Understanding Credit and Credit Scores” and “How to Manipulate Your Credit Score Higher” for information as to exactly how you can help a HomeStart-certified Mortgage Broker or Wholesale Broker to do this.

Related terms: Credit Report, Line Item, Trade Line, Credit Development.

AMC

Appraisal Management Company. Since the passage of the HVCC federal law, Appraisals cannot be ordered directly as there is to be no communication between the loan originator and the Appraiser. Thus, AMCs act as middlemen, taking Appraisal orders and distributing them to their member Appraisers. This is intended to combat overvaluation and loan originator-Appraiser collusion on values.

Related terms: Appraiser, Appraisal, HVCC, Fair Market Value.

AMORTIZATION

Mathematical formula that divides a debt plus interest into uniform payments where the majority of the interest is paid first and the majority of principle is paid last. This means that if the Principle and Interest on a Mortgage is $1,000 a month, the first payment will be made up of 97% Interest and only 3% Principle. If it’s a 30 year Mortgage then the opposite will be true when the Borrower is in his/her 28th, 29th and 30th year of payments. The reason that Amortization is the standard mathematical formuly for Mortgages is because most Mortgages are paid off in the first five to seven years after they are originated. This ensures that the Lender will receive the majority of the Interest to be made off the loan before the property is sold, refinanced or otherwise paid off. Almost all loans are Amortized, with the exception of an Interest Only loan.

Related Terms: Principle, Interest, Term.

AMORTIZATION ACELLERATION

Early payoff strategy. Amortization Acceleration is what happens when you pay an additional amount of Principle at a lower rate. For example, if a Borrower currently has a $200,000, 30 year Mortgage at 7.000% with 28 years left to pay and only has Refinance options in the 6.000% range, the Refinance can still make financial sense due to Amortization Acceleration. This means that if the new payment (at 6%) is only $130 less than the old payment (at 7.000%) and the Borrower makes sure that the $130 savings is applied (using a separate check) to Principle of the new Mortgage every month, the Amortization of the new Mortgage loan will be accellerated from 30 years to 23.3 years , and the Borrower’s overall payment does not change. This 4.7 year reduction in the Mortgage’s Term through Amortization Acceleration, the Borrower will even save $56,400 in Interest over the next 23.3 years. Thus, the conventional wisdom of “only refinance if you can get a rate 2% lower than your current one” is proven wrong.

Related terms: Amortization, Interest Rate, Term.

AMORTIZED

Having a specific number of payments. An Amortized Mortgage loan is one that is paid off over a specifc Term, based on a complex mathematical formula. Mortgage Amortization is set up so that the portion of the payment that is Interest is extremely large at the beginning of the loan and decreases, very slowly and non-uniformly, over time. Conversely, the portion of the payment that is earmarked to Principle is extremely small at the beginning of the loan and increases, very slowly and non-uniformly, over time. The result is a payment schedule where the vast majority of the entire Term’s Interest charges are paid back in the first few years of the loan, a unique attribute that allows for the Mortgage industry to be as large and as lucrative as it is, despite the fact that the majority of Mortgages are only in existence for an average of only five to seven years.

In Mortgaging, Amortization is also an Interest accrual type and can apply to both fixed and Adjustable Rate Mortgages. On an Amortized Mortgage, Interest accrues daily, but only as unpaid Interest (Interest charges are not capitalized onto the Principle of the loan). One exception to this rule is the FHA loan. An FHA loan will assess Interest due for the entire month at the beginning of the month.

Amortization is also a tax term. Tax Amortization means that the expense is deducted over a specific period of time. For example, the Points on a Refinance can be deducted in parts equal to the Term of the loan. On a new 30 year Refinance, 1/30th of the Points on the HUD-1 Settlement Statement (old form) or Closing Disclosure (current form) can be deducted each year for 30 years.

Amortization should not be confused with the “Due And Payable” number. For example, a 360/360 (a 30 year standard Mortgage) is a loan that is Amortized over 360 months (first number) and due in 360 months (second number). On Balloon Notes, however, these numbers are not the same. If you see “360/180” that is a 15 year Balloon Note. In this case the payments are small, as if they will be Amortized over 30 years or 360 months (the first number), but the “Due And Payable” number is 180 months, meaning that after the end of the 15th year of the loan, all unpaid Principle becomes due.

Related terms: Interest, Rate, Term, Adjustable Rate Mortgage, Balloon.

ANNUITY

Financial asset that gives a Borrower fixed monthly Income for life. Annuity Income is considered Fixed Income, along with Social Security Income and a Pension.

Related terms: Fixed Income, Social Security Income, Grossed Up, Pension.

APPRAISAL

A value determination of a property (house and land) using either a Sales Comparison Approach or a Cost Approach. The Sales Comparison Approach compares the Subject Property to three to five (usually) recently sold properties in the Subject Property’s area. These Sales Comps (when compared to the Subject Property) have what are called “Adjustments” that are dollar value additions and subtractions to the Sales Comp as it compares to the Subject Property. The end result is the value of the Sales Comp as if the two properties (the Sales Comp and the Subject Property) were almost identical. This, in turn, gives an estimate of the value of the Subject Property. The Cost Approach is used on Construction Loans or when a Sales Comparison Approach is not feasible. The Cost Approach gives Site Value to the land, value to any improvements (like fences, irrigation systems, etc.) and dollar per square foot values to the house, the garage, any other structures resulting in the value of what it would cost to rebuild the property.

Related Terms: Loan To Value, Sales Comps, Adjustment, Sales Comparison Approach, Cost Approach, Site Value.

APPRAISAL WAIVER

Attribute of the Findings from an Automated Underwriting system, specific to the property requirements for the loan. For example, if a Borrower has a home worth $900,000 and only owes $200,000, that Borrower may wish to Refinance his/her property from a 30 year Fixed Rate to a 15 year Fixed Rate. Because the proposed loan amount is such a low percentage of the property’s value (a low Loan To Value), if the Borrower has other positive file characteristics (like great credit or large Liquid Assets), the Automated Underwriting Findings may state that there is no requirement for an Appraisal in that transaction. Then, an “Appraisal Waiver certificate” needs to be obtained at a cost of between $75 to $125 (which is considerably cheaper than the cost of an Appraisal).

Related terms: Appraiser, Appraisal, Loan To Value, Refinance, Liquid Assets.

APPRAISE

To give a current value to something. In Mortgaging properties are Appraised so that two things can occur:

1. A Fair Market Value can be determined to show the Lender the strength of the collateral; and

2. A Fair Maker Value can be determined in order to know the Loan To Value and size of the proposed Mortgage.

Related terms: Fair Market Value, Appraiser, Appraisal, Sales Comp, Sales Comparison Approach, Cost Approach, Adjustement, Loan To Value.

APPRAISED VALUE

The Fair Market Value of the property assigned by an Appraiser who has Appraised the Subject Property. This is usually based on three to five Sales Comps sold in the last six months in the closest proximity to the Subject Property.

Related terms: Appraiser, Appraisal, Appraise, Fair Market Value, Subject Property, Sales Comp.

APPROVAL

See Loan Approval.

APR

The APR is the first box from the left on the Truth In Lending Statement. The APR is what the Lender will actually yield from the loan each year, including the Closing Costs paid to obtain the loan (as if they were spread out over the Term of the loan). The APR is the Interest that will be paid during the first year (the Interest Rate), plus certain costs that were paid for by the Borrower (or Seller in a Purchase transaction) to acquire the Mortgage. This inclusion of fees paid to acquire the Mortgage (as represented as a percentage of the loan) is why the APR is slightly higher than the Interest Rate of the loan. If there were no Closing Costs, then the APR would be identical to the Interest Rate. The APR is an excellent way to compare loans (provided all attributes between the loans are the same (Term, Amortization, Prepayment Penalty, Balloon, etc.) because it is a more complete representation of the total cost of the loan, as opposed to simply comparing the Interest Rate. For example, a 3.875% Interest Rate with a 4.225% APR is actually more expensive than a 4.00% Interest Rate with a 4.082% APR, however, it is important to note that using the Breakeven and Recoup formulas are even more precise at determining the prudence of how much Closing Costs are best. For example, a No Point Loan may have a lower APR than a loan with two Discount Points, but both the Recoup and the Breakeven formulas may prove that it is the best loan for the Borrower’s short-term and/or long-term financial goals. The APR is an oversimplified, government number that does not take into account how long the Borrower intends on remaining connected to the loan. Therefore, it is HomeStart’s opinion that a complete analysis of the loan (using the Breakeven and/or Recoup formulas) is a better way to compare loans than the APR. If this is too painstaking for the Borrower, a HomeStart-certified Broker or Banker can certainly do it.

Related terms: Prepaid Finance Charges, Interest Rate, Origination, Discount.

ARM’S LENGTH

Documented, non-familial transaction. For example, obtaining a Down Payment for one property from a Cash Out transaction on a different property would be an Arm’s Length Transaction. A sale of a home from a brother to his sister, however, would be Non-Arm’s Length Purchase.

Related terms: Down Payment, Cash Out, Investment Property, Second Home, Primary Residence, 1031 Exchange.

ARTICLE 11

Article from the National Association of Realtors® Code of Ethics which reads, “The services which the REALTORS® provide their clients and customers shall conform to the standards of practice and competence which are reasonably expected in the specific real estate disciplines in which they engage; specifically, residential real estate brokerage, real property management, commercial and industrial real estate brokerage, real estate appraisal, real estate counseling, real estate syndication, real estate auction, and international real estate.

REALTORS® shall not undertake to provide specialized professional services concerning a type of property or service that is outside their field of competence unless they engage the assistance of one who is competent on such types of property or service, or unless the facts are fully disclosed to the client. Any persons engaged to provide such assistance shall be so identified to the client, and their contribution to the assignment should be set forth".”

Related Terms: Realtor®, Real Estate Agent

ARTICLE XVI, SECTION 50(A)(6)

While most of conventional, conforming (see QM) mortgaging is extremely uniform, there is one state that does cash out loans differently than all the rest. That state is Texas. For 158 years (since the formation of Texas as a state), citizens could not borrow against the equity of their homes. In 1998, the Texas State Legislature altered the constitution and finally provided for home equity lending in the state of Texas. This article of the constitution is Article XVI, Section 50, Subsections (a)(6) and (a)(4), the latter being added years later to allow HELOC second mortgages. Often this law is referred to as “A6” or the loans as “A6 loans”. The differences between Texas’s cash out rules and the rest of the nation’s include the following highlights:

Both first and second lien Home Equity loans are allowed.

Once a Home Equity loan in Texas, always a Home Equity loan, unless the property is no longer your homestead and that can be proven. This is true even if two loans are being paid off where only one is a prior Home Equity loan. This is also true even if the new loan is not releasing any cash or paying off any non-lien debts.

Only one Home Equity loan may be attached to the property per year, whether or not a prior Home Equity loan has a balance. This mean one every 365 days, not calendar year.

There is a two percent cap on fees charged in conjunction with a Home Equity loan, excluding a limited number of fees and YSP. This means that all fees either charged to the client or related to the client’s acquisition of a Home Equity loan cannot exceed two percent of the loan’s value (again, excluding the title policy, YSP and prepaid items such as reserves or interest to the end of the month). “In conjunction with” is used because a survey, for example, that the client “does on their own” that is actually shot (measured by the surveyor) after application for the loan has been made for the Home Equity loan would be considered a cost that was incurred by the client in conjunction with the Home Equity loan since surveys are required in 95% of all Home Equity loan originations.

Acreage generally must be platted as ten acres or less (for urban and suburban properties), however investors may limit the FMV on the property to the value of the home plus only five of the acres. Rural properties can be secured with more than 10 acres.

The limit for lending on a Home Equity loan in the State of Texas is defined as 80% of the FMV of the property less all liens on the property. For example, if a property has a lien for $50,000 on the title and the property is worth $100,000 there is only $30,000 of equity that may be accessed in the State of Texas, not $50,000.

There is a 12 day “cooling off” period after the date of application. This portion of the constitution specifically states “The loan may not close before 12 days after you submit a written application to the lender or before 12 days after you receive this notice [the “12 Day Letter”], whichever date is later...” Some investors interpret this to mean that not only does the Loan Officer have to execute the Loan Application with the client but that the Loan Officer may also have to fax or otherwise deliver it, and the 12 day letter, to the investor before the 12 day cooling off period begins to tick. Sometimes this will also include the execution and delivery of other documents that are specific to the investor and/or their specific 12 day letter (see Tx C/O Specific Disclosures on the Company Intranet).

There may not be an agricultural exemption on the property unless that agricultural exemption is specifically in conjunction with milk production (on the property).

There may be no blanks whatsoever on the written loan application. Some investors take this to the extreme and do not permit any handwriting on the 1003, GFE and TIL and require that all portions of these three forms be typed.

Any debts that are intended, at application, to be paid (via a listing on the loan application) may be considered fair game by the investor. For example, the client could suggest that they wish to pay off two $10,000 credit cards with the proceeds of the loan. If the originator checks the “Will be paid off (*)” field for these two debts on the loan application, an investor may require that they be paid off from the loan proceeds, even if the appraisal comes in low and there is not enough room in the loan to accommodate them. This situation would require the client to bring funds to the closing of the “cash out” loan.

All fees on the loan must be disclosed to all title owners on the property at least 24 hours before the closing may take place. Thus, closing instructions usually go out to the Title Company, the HUD is approved and executed by the Borrower(s) and the loan will actually close the next day, when rescission will begin.

The lender cannot force the applicant to pay off other debts on which the investor is also the creditor.

With some exceptions, title on the property before the loan must be identical to title after the loan closes. If, for example, a property that only has the husband in title will be the subject of a Texas cash out loan and the client wishes to add the wife to title as part of the transaction, this addition of the wife to title (via a warranty deed) must be done prior to taking the loan application, so that title before the transaction is identical to title after.

All owners of the property must sign the loan application, Mortgage Loan Origination Agreement and the 12 Day Letter.

It is constitutionally prohibited for there to be any penalty or charge for early payoff. Therefore, Tx C/O loans never have a prepayment penalty, a “fax charge” or any other fee.

Stacking of a Home Equity loan on top of another Home Equity loan is not allowed.

The lender cannot force the Borrower(s) to payoff any portion of the loan due to fair market value falling on the property after the loan has been originated.

The broker is not legally responsible for the loan being done improperly (per the constitution) if the loan is brokered, the lender is. This one rule is the reason why many lenders will not do cash out loans in the state of Texas. This does not imply that mortgage brokers are doing the loans irresponsibly. It means that the lenders do not trust their compliance departments or understand the law well enough to take on that level of risk.

Two additional title endorsements are required. These are the T-42 (10% of base title policy) and T-42.1 (15% of base title policy).

If prior year’s property taxes are to be paid by a loan, then the loan must be considered a Texas cash out loan.

There is no leniency to the cash released, debts paid or prior year’s property taxes being paid by the loan. If one cent of equity is taken from the property that does not pay off a prior, non-Texas cash out lien, then the loan is an “A6”.

Related terms: Cash Out, Discount Points, Prepaids, Title Insurance, T42, T42.1

ASSESSMENTS

Monthly dues including those for a Homeowners Association, and amenities. Parking is also sometimes included in Assessments.

Related terms: Homeowners Association.

AS IS

Current condition. A Contract can be executed as an As Is Contract meaning the Buyer accepts the Subject Property in its current condition and requires no repairs by the Seller in order for the transaction to be consummated. An Appraisal can be done As Is (as the majority of Appraisals are), meaning that the value assigned to the property is not Subject To any repairs or improvements of any kind and is therefore Appraised in its current condition.

Related terms: Contract, Subject Property, Seller, Buyer, Appraisal, Subject To.

ASSUMABILITY

The ability for a Mortgage loan to be Assumed; that is, whether or not a Mortgage loan was set up with the ability for another party to Assume it.

Related terms: Assumable, Assumption, Assume, Government, Mortgage.

ASSUMABLE

A loan that allows for another party to assume the Mortgage Payments and Mortgage (instead of going and getting his/her own Mortgage). Related terms: Assumption, Assumability, Assume, Government, Mortgage.

ASSUME

To take over the Mortgage Payments and the Mortgage of another person or persons.

Related terms: Assumability, Assumable, Assumption, Government, Mortgage.

ASSUMPTION

Taking over a person’s loan and Mortgage Payments without releasing that person of personal liability.

Related terms: Assumable, Assume, Assumability, Government, Mortgage.

ATTORNEY IN FACT

Appointed person or organization in a Power Of Attorney document. The Attorney in Fact is granted signing authority in a Specific Power Of Attorney in a Mortgage transaction.

Related terms: Agent, Specific Power Of Attorney, Power Of Attorney.

AUDITED

Certified that the financial document was prepared by a CPA. Many times a Profit & Loss statement, for example, can simply be signed by the owner(s) of the business to qualify for a Mortgage. But in some cases, the Underwriter may require that the Profit & Loss actually be Audited. This means a full audit of the business’s financials must be completed so that the CPA can certify that the Profit & Loss has been Audited. Audits cost a considerable amount of money, so it is HomeStart’s suggestion that if a Borrower is being asked to provided Audited financials, he/she should first request a free referral to a HomeStart-certified Broker or Banker who can quite possibly get past this Underwriting Condition without the Borrower having to incur a large expense. A HomeStart-certified Broker for example, could use an Underwriter at a particular Lender who would not require Audited Financials, since he/she has numerous Lenders in his network.

Related terms: CPA, Profit & Loss, Underwriter, Broker.

AUTOMATED UNDERWRITING

Computer program that assesses loan risk. There are two main Automated Underwriting engines - Fannie Mae’s Desktop Underwriter and Freddie Mac’s Loan Product Advisor. Mortgage “loan specialists” answering 800 numbers for companies that run national advertising and offer “immediate” or “10 minute” Loan Approval are simply typing the information the Borrower gives him/her into an Automated Underwriting engine. This simply assures the Lender that the information given to him/her by the Borrower conforms to either Fannie Mae or Freddie Mac’s guidelines (in the form of Findings). This does not, however, mean that you have a Loan Approval. The most important thing about Automated Underwriting engines is that the Findings are only as good as the data entry. If the Borrower incorrectly gives his/her Self-Employed income, for example, as Gross sales rather then Net Income, the Findings (perhaps a Loan Approval) will be meaningless, because the data entered could not be proven. Therefore, it is HomeStart’s intention that you take no action of substance (like putting in an Offer on a house) based on a “Loan Approval” given according to incorrect, verbal information. Instead, it is best to request a free referral to a HomeStart-certified Broker or Banker and then to apply for a Mortgage loan. Then supply the Broker or Mortgage Banker with all relevant financial data so that Automated Underwriting data entry is done based on verified facts rather than the Borrower’s guesses or estimates.

Related terms: Fannie Mae, Freddie Mac, Desktop Underwriter, Loan Product Advisor, Findings, Self-Employed, Gross Income, Net Income.

AWARD LETTER

Annual letter received by Social Security Income recipients, Pension recipients and Annuity recipients proving their annual and monthly benefit.

Related terms: Social Security Income, Pension, Annuity, Grossed Up, Fixed Income.

B

BACK

Compensation from the Lender to the Broker or Mortgage Banker. This is also referred to as Yield Spread Premium or Service Release Premium. Beginning on April 1, 2011 the Borrower is supposed to be able to choose whether they want the compensation on a loan to come entirely from the Front of the loan, or entirely from the Back of the loan. Whether the Borrower chooses the Back or it is chosen for them, all of the Broker’s or Banker’s Commission will come from the Interest Rate sold and the Borrower will not be able to obtain a wholesale Rate. If the Borrower chooses the Front (or if it is chosen for them), the Borrower will pay the compensation for the Broker or Banker in increased Closing Costs. While a Front-loaded loan gives the Borrower a Wholesale Par Rate it is only best if the Borrower plans on keeping the loan for a considerable amount of time. Front Loaded loans also keep the Mortgage Payment lower. Loans where compensation is derived solely from the Back of the loan should only be chosen if the Borower will only be keeping the loan for a very short period of time.

Related terms: Front, Yield Spread Premium, Service Release Premium, Interest Rate, Wholesale Par, Closing Costs.

BACK RATIO

Risk standard. The Back Ratio can be calculated by taking the entire Housing Expense plus all consumer debt minimum payments (credit cards, installment loans, student loans, lines of credit) that appear on the Borrower’s credit report, divided by Gross Income (W2) or Net Income (Self-Employed). Back Ratios generally should not exceed certain limits. However, strong Mortgage profiles (excellent credit, low Loan To Value, high Liquid Assets) can be run on an Automated Underwriting engine to see if the following general limits can be exceeded. These limits are:

• 45% for most Prime, Conventional Conforming loans;

• 38% for most Prime, Jumbo loans;

• 41% for most FHA and VA loans (Government loans);

• 43% for Prime (good credit), Conventional Borrowers with Non-Resident CoBorrowers;

• 43% for FHA and VA loans doing new construction (building a home);

• 45% for Construction Loans;

• Up to 60% for Conventional loans with compensating factors, run on an Automated Underwriting engine;

• Up to 49.99% for very good or excellent credit, Government loans with Compensating Factors, run on an Automated Underwriting engine;

• 45% for a Combo loan Second Mortgage (See the HomeStart Specialty Tutorial “How and Why To Do a Combo Loan”); and

• 45%, 50% or 55% for Non-QM loans (depending on Lender).

HomeStart verifies that all HomeStart-certified Brokers and Bankers have enough access to enough Lenders that some will not have Overlays limiting the Back Ratio. This can mean the difference between getting a Mortgage Denied and getting a Loan Approval.

Related terms: Debt To Income Ratio, Front Ratio, Overlay.

BALLOON

Loan Term (period of time). Balloon loans start out with an Amortized Term and a Due And Payable period that are different. Often this is when the Due And Payable period is shorter than the Term. For example, a 5 year Balloon is Amortized over 30 years (to determine the payments) which is a term of 360 months, but it is Due And Payable in five years. This Balloon Note loan product would be expressed as a 360/60. Another example would be a 15 year Balloon. These loans are usually Amortized over 30 years (or 360 months). Thus, this product would be expressed as a 360/180 (number of months corresponding to a 30 year Amortized loan that is Due And Payable in 15 years). The point at which the loan is Due And Payable is called the Maturity Date.

Related terms: Term, Due And Payable, Maturity Date.

BANKER

See Mortgage Banker or Retail Banker.

BANKRUPTCY

A filing for debt relief under federal Bankruptcy laws. A Bankruptcy (Chapter 7) must be fully discharged for at least two years before the Borrower can obtain a Government loan. Some Government loan files (using a HomeStart-certified Broker or Banker) can even be approved after only one year following a Chapter 7 Bankruptcy. Conventional loans immediately following a Bankruptcy are not possible. Conventional loans require a longer post-Bankruprtcy period and re-established positive credit.

For a Chapter 13 Bankruptcy, in order to obtain a Government loan, a Borrower’s Chapter 13 Bankruptcy must be in force (making payments) for at least one full year. All payments must have been made on-time and in-full, and the permission of the Trustee must be obtained before the Borrower can obtain a Government loan. Conventional loans sometimes require that the Borrower has completely finished the payment plan and has fully exited a Chapter 13 Bankrtupcy in order to obtain a Mortgage loan.

HomeStart understands how a Bankruptcy will affect a Borrower’s life, but sometimes it is unavoidable. In those cases, HomeStart verifies that all HomeStart-certified Brokers and Bankers have FHA Lenders who honor the guidelines regarding Bankruptcy so that Borrower can still achieve the American dream.

Related terms: Chapter 7, Chapter 13, Government, Conventional, FHA, 4000.1.

BANK STATEMENT LOAN

Documentation type in the Subprime market where Income is declared on the Uniform Residential Loan Application and bank statements are used to demonstrate Income. For a W2 employee this is done by adding up all deposits over a specified period of time then dividing that total by the number of months in the period. For a Self-Employed individual, this is done by taking the ending balances of the business bank statements and adding them all up over a specified period of time then dividing that total by the number of months in the period. Liquid Assets and employment are verified.

Related terms: W2, Self-Employed, Liquid Assets, Income, Analyzing Income.

BASE LOAN AMOUNT

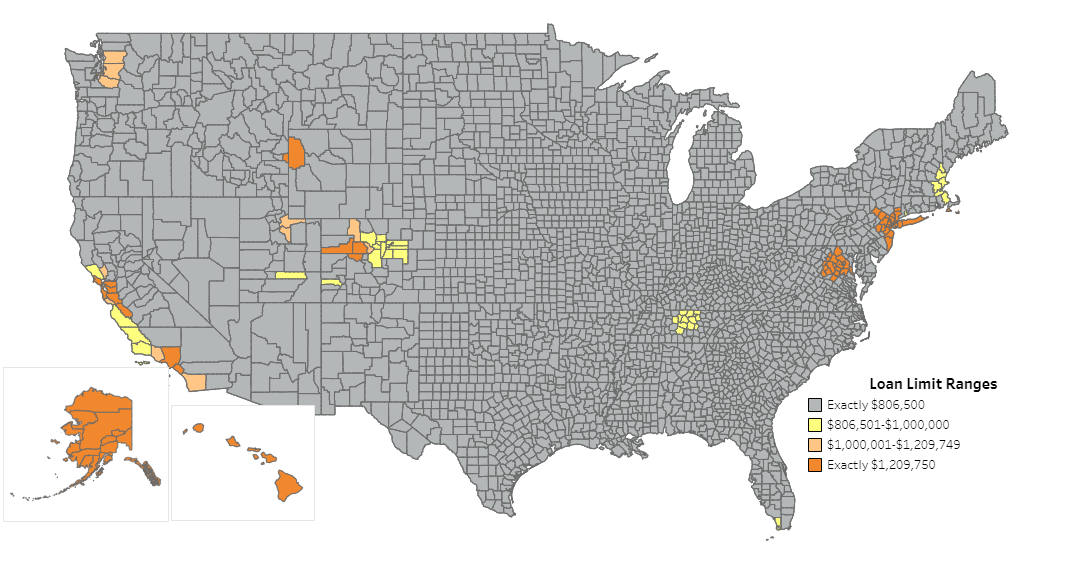

Loan amount on an FHA loan prior to any addition of Mortgage Insurance Premium; Loan amount on a VA loan prior to any addition of the Funding Fee. FHA Base Loan Amounts are limited by U.S. county. VA Base Loan Amounts are limited by the Conforming loan amount limit. To find your county Base Loan Amount limit, go to: http://themortgagereports.com/loan-limits/.

Related terms: Mortgage Insurance Premium, Funding Fee, FHA, VA, Final Loan Amount.

BID

See Offer.

Related terms: Purchase, Offer, Contract, Sales Contract, Purchase Contract, Listing.

BLUEPRINTS

Original architectural drawings (architectural plans).

Related terms: Plans, Specs, Construction Loan.

BLUES

Original Surveys. When a Survey is ordered, the loan originator gets a copy and the original blues are sent to the Title/Escrow Company. At least one Blue goes to the Borrower.

Related terms: Survey, Title/Escrow Company.

BONUS

A financial incentive given to an owner or an employee of a company. Bonuses are Qualifying Income provided they are averaged over the past two years and that they are likely to continue. Bonuses paid in the current year or guaranteed (but not yet paid) do not count as Qualifying Income.

Related terms: Income, Gross Income, Net Income, Analyzing Income, Qualifying Income.

BORROWER

The main applicant on a Mortgage loan.

Related terms: Mortgagee, Buyer, Seller.

BORROWER-PAID (COMPENSATION)

Choice of Borrower to pay the compensation involved in a Mortgage on the Front of the loan (charged to the Borrower). This means that the loan originator’s commission will be paid entirely by the Borrower or the Seller. This lowers the Interest Rate since the Lender will not be paying any of the compensation involved in the Mortgage. The choice of Borrower-Paid Compensation is good when you plan on keeping the property for a very long time and not Refinancing it anytime soon. The only other option is to choose Lender-Paid Compensation and the Lender will pay the loan originator’s commission; however, the Borrower’s Rate will be higher and/or the loan will come with some amount of Discount Points. It is important to remember that an intelligent loan originator (all HomeStart-certified Brokers and Bankers are interviewed regarding the use of Borrower-Paid and Lender-Paid Compensation) will either roll Borrower-Paid Compensation into the new loan amount (on a Refinance) or get the Seller to pay for it (on a Purchase). Anyone buying a property should seriously consider doing a Borrower-Paid Compensation transaction and having the Seller pay the bill at Closing. This gets the Borrower the best of both worlds: A low Interest Rate for practically nothing and a large tax deduction because Discount Points were paid in order to acquire the Mortgage. See the HomeStart Specialty Tutorials, “Tax Advantage Mortgaging” and “Tailor the Mortgage Youself and Save Thousands - Front Loaded Purchase/Refinance.

Related terms: Front, Back, Lender-Paid Compensation, Discount, Points, Refinance, Purchase.

BORROWER PAID MORTGAGE INSURANCE

See Mortgage Insurance.

Related terms: Lender Paid Mortgage Insurance.

BORROWER’S CERTIFICATION & AUTHORIZATION

Loan Application Disclosure that certifies that the Borrower has indeed applied for a Mortgage loan and that the Borrower gives the loan originator the right to gather information on the Borrower in order to process the Mortgage Loan Application.

Related terms: Loan Application, Credit Report, Verification of Rent, Verification of Deposit, Verification of Loan, Verification of Mortgage, Verification of Employment.

BPC

See Borrower Paid Compensation.

Related terms: Front, Back, Lender-Paid Compensation, Discount, Points, Refinance, Purchase.

BREAKEVEN

Calculation to determine when the Refinance will “pay for itself”. This is the number of months that it will take for the Borrower to “save back” all of the costs of the Refinance when the Refinance lowers the monthly payment. One of the most important aspects of doing a Refinance is calculating the Breakeven. This calculation is performed as follows:

This number, once derived, is then compared to the number of years (or months) that the Borrower intends to keep the new loan. If the Breakeven occurs sooner than that time period of expected connection to the loan, it is ethical and financially wise to do the loan. The use of a Breakeven calculation, of course, assumes that the Borrower’s payment will be lowered.

There is always the possibility that the Borrower does not know how long he or she will be connected to the new loan. In this case, the Borrower should consider his/her residential history. For example, if a Borrower has lived in the Subject Property for two years and lived in the prior home for ten years. It might be safe to assume that the Borrower will keep the new loan for the next eight years. If the Borrower also turned the prior home (of eight years) into an Investment Property, then it is even safer to assume that the Borrower will keep the new loan for ten or more years. Such a residential history suggests that despite uncertainties, the Borrower’s overall tendency is to both live in a property for long periods of time and to keep loans for a long time (by turning the last house into an Investment property). This would indicate that a new loan, with a reasonable Breakeven, would be ethical and most probably be in the best financial interests of the Borrower as the Breakeven will occur while the loan is still held by the Borrower.

A Breakeven can also be performed on a Cash Out loan where the overall monthly costs after the transaction are lower that they were before. For example, if a Borrower (before the transaction) is paying a $700/month Mortgage Payment (PI only), and $1,500/month in car loans and credit card minimum payments and the new Mortgage Payment (which is paying off the old Mortgage, the cars and the credit cards) will be $1,650 (PI) , this $550 in monthly savings can be considered the reduction in payment.

Related terms: Closing Costs, Points, Cash Out, Refinance, Subject Property, Investment Property.

BRIDGE LOAN

Temporary loan on a current property for the purchase of another property. Basically, a Bridge Loan lets one borrow the Equity from one house to put in the Down Payment on another house. There is no prepayment penalty on a Bridge Loan because it is intended to only be for a short period of time.

Related terms: Equity, Prepayment Penalty.

BROKER

Mortgage professional with access to more than one Lender, acting on behalf of the Borrower. A Broker can access loan programs from the Wholesale departments of retail banks (like Wells Fargo, Bank of America, etc.), private investors, Wholesale Lenders and other sources. A Broker must disclose the Yield Spread Premium he or she makes on the Back of the loan (from the Lender).

Related terms: Yield Spread Premium, Front, Back.

BUILDER

See General Contractor.

Related terms: Construction Loan, Custom Builder, General Contractor.

BUILDER BUILD

When the Borrower of construction funds is also the General Contractor. This can mean either that a Borrower of a Construction Loan will be the person who hires, supervises and pays all of the Subcontractors or that a professional Builder will be building his/her own home. See the HomeStart Specialty Tutorial, “How to Do a Construction Project”.

Related terms: General Contractor, Construction Loan, Subcontractor.

BUILDER’S RISK INSURANCE

Insurance policy held by the Custom Builder’s insurance company that covers all of the materials that will be on the property during a construction project. This policy is required when doing a Construction Loan. See the HomeStart Specialty Tutorial, “How to Do a Construction Project”.

Related terms: Custom Build, Custom Builder, Builder Build, General Contractor, Construction Loan, Subcontractor.

BUILDING LINES

Invisible lines on a property that determine the area on various portions of a property where structures may and may not be built. Building Lines are visable through a Survey. See the HomeStart Specialty Tutorial, “How to Do a Construction Project”.

Related terms: Survey, Public Utility Easement, Setback, Land Survey, Form Survey, Final Survey.

BUREAU

Credit Repository. See Credit Bureau and the HomeStart Specialty Tutorials “Understanding Credit and Credit Scores”, “How to Instantly Build Credit when You Have None” and “Manipulating Your Credit Scores Higher”.

Related terms: Credit Report, Credit Scores, Credit Development, Repository.

BUY DOWN

The addition of Discount in order to acquire a particular Rate. Buydown Points are paid to the Lender. How far a Borrower should Buydown the Rate is a mathematical question with a mathematical answer. The choices between Interest Rates will have respective costs and monthly savings. These variables are used to mathematically decide how low to Buydown the Rate, based on how long the Borrower intends to keep the loan. To figure out these variables, the HomeStart Mortgage Calculator should be used, along with the Recoup formula. If, for example, a Borrower plans on keeping a home for seven years following the origination of the loan, then it is possible that a Buydown could benefit the Borrower, provided the number of months it would take to Recoup the cost of the Buydown is less than 84 months (seven years). This situation is examined as follows:

Assume the loan in question is a $100,000 loan with a Term of 15 years. On the left side of the Recoup formula, the monthly payment differences of various Rates are compared against a 7.75% standard (in the preceding graphic, the difference in red between a 7.75% payment and a 6.75% payment would be $55.28/mo). To arrive at these monthly payment differences, establish the payment for 7.75% (or whatever your standard will be), determine the payments for other available Rates, then subtract each payment from the payment for the standard. This is illustrated on the left side of the preceding graphic. These calculations can be done using the HomeStart Mortgage Calculator. You only need to enter the loan amount ($100,000), the Term (15) and the Interest Rate to get each payment. Subtracting each payment from the payment for the standard is simple subtraction.

On the right side of the preceding graphic the costs of the Rate choices are compared against the standard of $0 (the black line of 7.75%). The goal then is to divide the difference in cost by the differnce in monthly payment to arrive at the number of months it would take to Recoup the costs. This is done through simple division.

For example, the $500 cost (in blue) of the lowering of the Rate from 7.75% to 7.50% is divided by the $13.99 monthly savings (in blue) to equal 35.74 months to Recoup. Lowering to 7.25% (in pink) divides the $1,000 difference by the $27.86 monthly savings and would Recoup in 35.89 months; 7.00% (in green) would Recoup in 48.05 months; 6.75% (in red) would Recoup in 49.75 months.

This comparison of Rates and associated costs shows clearly that the quickest period of Recoup is the period corresponding to lowering the Rate from 7.75% to 7.5%; however, it also demonstrates that the longest period of Recoup is the period corresponding to lowering the Rate to 6.75%, which is 49.75 months, which is only slightly longer than four years. If the Borrower plans on keeping the new loan for at least seven years, then all Rate choices would be appropriate. Actually, lower Rate choices would even be appropriate, provided the Recoup period did not approach the seven year mark. See the HomeStart Specialty Tutorials, “Do-It-Yourself Mortgage”, and “Tailor the Mortgage Yourself and Save Thousands - Front Loaded Purchase/Refinance“.

Related terms: Purchase, Refinance, Rate, Interest, Discount, Points.

BUYER

The purchaser of a property, to whom Title will convey, in a Purchase transaction. See the HomeStart Specialty Tutorial, “Looking for Real Estate without a Realtor®”.

Related terms: Borrower, Seller, Purchase, Title.

BUYER’S AGENT

Real estate agent representing the Buyer or purchaser. This is also referred to as the Selling Agent.

Related terms: Realtor®, Selling Agent, Listing Agent, Purchase.

BUYER’S AGREEMENT

Legal document binding the Buyer to a specific Real Estate Agent for a specific period of time. HomeStart encourages Buyers not to sign Buyer’s Agreements with Real Estate Agents. See the HomeStart Specialty Tutorial, “Looking for Real Estate without a Real Estate Agent”.

Related terms: Realtor, Buyer’s Agent, Selling Agent, Purchase.

BUYER’S MARKET

When housing inventory is high and Seller’s are under pressure to make favorable concessions (Purchase Price, Seller Contributions, etc.) in order to achieve sales.

Related terms: Purchase Price, Seller Concessions, Seller Contributions.

C

CALCULATING INCOME

See Income Analysis.

Related terms: Income, Gross Income, Net Income.

CALLING THE NOTE

Accelerating the Mortgage so that all payments are immediately Due And Payable. Usually Calling The Note is a result of the Borrower’s Default on the Mortgage.

Related terms: Note, Balloon, Acceleration, Default.

CAP

Periodic increase/decrease limit. The periodic limit for increases and decreases to the Interest Rate on an Adjustable Rate Mortgage product. Caps can be an Initial Cap, a Periodic Cap or a Lifetime Cap.

Related terms: Adjustable Rate Mortgage, Initial Cap, Periodic Cap, Lifetime Cap, Margin, Index, Floor.

CASE NUMBER

A unique identified given my FHA Connection for every FHA loan registered at any Retail Originator, Retail Bank, Mortgage Banker or Mortgage Broker. The date that the Case Number is issued is extremely important as new Mortgagee Letters can effect the financial paramenters of both Upfront MIP and Monthly MI.

Related terms: FHA, Streamline Refinance, Upfront MIP, Monthly MI, CAIVERS, GSA, LDP, FHA Connection.

CASH FLOW

Calculation for the evaluation of whether or not an Investment Property Purchase is recommended. See the HomeStart Specialty Tutorials, “Properly Buying Investment Property” and “Buying Multifamily Housing - Becoming a Landlord in One Easy Step”.

Related terms: Rental Property, Investor Property, Non-Owner Occupied Property, PITI.

CASHIER’S CHECK

A method of payment that is immediately negotiable funds. Cashier’s Checks can be acquired at a bank or credit union. Also known as a Certified Check. However, due to the speed at which Title/Escrow Companies are increasingly required to operate and to the growing threat of money laundering, most Title/Escrow Company policies are to take bank wires for Closing funds from Borrowers.

Related terms: Closing.

CASH OUT

A transaction in which Equity is extracted from the Subject Property. This can present itself as releasing cash to the Borrower, paying off credit card or other debts, paying a contractor or home improver, etc. In most states, this refers to a loan where the Borrower is receiving more than 2% of the loan’s value in cash (less than 2% would still be considered a Rate/Term Refinance) or where debts are being paid off. In one state, Texas, this refers to a Refinance where cash is received by the Borrowers (even a penny), where any debts are paid off (other than Liens), where any back taxes are being paid off or where contracts that are not Liens against the property are being paid with the loan. Keep in mind that a Cash Out Refinance can also contain a change in the Rate, the Term or both.

Related terms: Equity, Refinance.

CASH SAVED AT HOME

Funds that can be used in a Government Mortgage transaction. The Borrower would have to show a written budget proving that over a specified period of time, the Borrower was able to save a specified dollar amount without having a checking, savings or other Liquid Assets account. This budget is a Cash Saved At Home letter.

Related terms: Government, FHA, VA, USDA, Down Payment, Liquid Assets.

CASH VALUE

Surrender value of a Whole Life Insurance policy. The majority of the Cash Value is considered a Liquid Asset because it can be accessed with a phone call.

Related terms: Liquid Assets, Whole Life Insurance.

C-CORPORATION

A business entity. C-Corporations can be private or public and are businesses that sell themselves in pieces or in stock. Stock is simply the shares you own in a C-Corporation. Interest & Dividends from stock ownership in a C-Corporation belong on Schedule B of an Income Tax Return.

Related terms: LLC, S-Corporation, Sole Proprietorship, Partnership.

CERTIFICATE OF ELIGIBILITY

VA certificate that proves that the Borrower is eligible to participate in the VA program. A Certificate of Eligibility will be required before the loan can be Closed. Additionally, the Certificate of Eligibility indicates to the Mortgage originator if it is the first time or a subsequent time that the Borrower has exercised his/her VA housing benefit.

Related terms: VA, DD-214, Funding Fee.

CERTIFICATE OF OCCUPANCY

Certification from the municipality in which the Subject Property is located that gives the owner the right to inhabit the property. Some municipalities require Certificates Of Occupancy only for Owner Occupied properties. Other municipalities require them for all properties. Some have no Certificates Of Occupancy and still others only require them when the property has been under construction. Some states (like New York, for example) require Certificates Of Occupancy every time the property changes hands. See the HomeStart Specialty Tutorial, “How to Do a Construction Project”.

Related terms: Subject Property, Owner Occupied.

CHANGE IN CIRCUMSTANCE

This is any change that takes place to the characteristics of a loan (Rate, loan amount, Term, addition or removal of a Prepayment Penalty, etc.). When a Change In Circumstance occurs, the Borrower must receive a new Loan Estimate. The acronym for this term is CIC.

Related terms: Rate, Closing Costs, Term.

CHANGE OF CIRCUMSTANCE

This is any change that takes place to the characteristics of a loan (Rate, loan amount, Term, addition or removal of a Prepayment Penalty, etc.). When a Change In Circumstance occurs, the Borrower must receive a new Loan Estimate. The acronym for this term is COC.

Related terms: Rate, Closing Costs, Term.

CHARM BOOKLET

Consumer Handbook on Adjustable Rate Mortgages. This handbook offers detailed information about Adjustable Rate Mortgages and is required to be given to any Borrower applying for a Mortgage loan that will be an Adjustable Rate Mortgage. This handbook can be found at: http://www.federalreserve.gov/pubs/arms/arms_english.htm.

CHATTLE

Property that can be moved, like an automobile or a Manufactured Home that still has its axles, wheels and tongue.

Related terms: Manufactured Home, Chattle-Land Conversion, VIN.

CHATTLE-LAND CONVERSION

Transaction in which Chattle (a non-attached Manufactured Home), and the land upon which it sits, is converted to Real Estate by surrenduring the VIN and permanently attaching (physically and through Title) the home to the land.

Related terms: VIN, Chattle, Real Estate, Title, Manufactured Home.

CIC

See Change In Circumstance.

CLEAR TO CLOSE

Final Underwriting Approval where a loan has cleared all Conditions and may now close between the date of Loan Approval and the date the first Credit document expires. If, however, the loan does not close in a timely manner, the Clear To Close will switch back to a Conditional Approval and updated documents (such as bank statement, most recent paystub, etc.) can be required for a new Clear To Close.

Related terms: Loan Approval, Conditional Approval.

CLOSING COSTS

Costs on the Front of the loan from the Lender, the Broker (or Wholesale/Retail Banker) to pay for the costs and sometimes the compensation on the loan. Additionally Title charges, recording, Survey, Appraisal, Closing documents, etc. are all considered Closing Costs. To assist the Borrower with a breakdown of all fees that are part of his/her Mortgage can be found on the Loan Estimate and the Closing Disclosure to ensure that all loan attributes are the same between the loans being compared).

Related terms: Origination, Discount, Points, Loan Estimate, Closing Disclosure.

CLOSE

Execute the Mortgage documents. Also, ending Escrow (in Escrow states).

Related terms: Closing, Closer, Title/Escrow Company.

CLOSED END

With a definite Term, that is, with an ending point.

Related items: Open End, Second Mortgage.

CLOSER

Either the Title/Escrow Company agent who is notarizing the Borrower signatures, the Closing Attorney who is supervising the Closing or the person who prepares the file for Closing at the Lender’s offices.

Related terms: Close, Closing, Title/Escrow Company.

CLOSING

Appointment at either a Title/Escrow Company or a Closing Attorney’s office to execute the Mortgage and/or Seller documents.

Related terms: Purchase, Refinance, Close, Closer.

CLOSING ATTORNEY

Attorney who specialized in Real Estate transactions and Closings.

Related terms: Close, Closing, Earnest Money, Deposit.

CLOSING DATE

Contract date by which the Mortgage documents must be executed.

Related terms: Close, Closing, Closer, Title/Escrow Company, Purchase.

CLOSING DISCLOSURE

Final summary of the transaction details for a Mortgage Closing required on all Real Estate transactions that are 1-4 Family dwellings secured by a federally related mortgage loan. A Closing Disclosure is required under the TILA-RESPA Intergrated Disclosures (TRID) set forth in 2015 as an enhancement to the Wall Street Reform & Consumer Protection Act. This applies to both Purchase and Refinance transactions.

Related terms: TRID, Loan Estimate, Change In Circumstance, Change Of Circumstance, CIC, COC.

CMA

Comparative Market Analysis. The research a Real Estate Agent conducts when trying to arrive at a Listing Price for a property or when preparing an Offer on a property. You should always ask for a copy of the CMA that was performed.

Related terms: Realtor, Buyer’s Agent, Seller’s Agent, Selling Agent, Listing Agent.

COBORROWER

The co-Applicant on a Mortgage loan, whether a spouse or a non-spouse.

Related terms: Borrower, Non-Resident CoBorrower.

COC

See Change Of Circumstance.

COFI

Cost of Funds Index. Mortgage loans exist that are based on the COFI index. These Mortgages are Adjustable Rate Mortgages. These are like regular Adjustable Rate Mortgages except that after the Fixed Period they usually adjust monthly and adjust based on the COFI, or an average of the COFI plus a Margin of profit. The current COFI index can be found at: http://mortgage-x.com/general/indexes/wells_fargo_cofi.asp.

Related terms: Adjustable Rate Mortgage, Index, COSI.

COLLATERAL

Property being used to secure a Mortgage loan. Collateral is a large part of the Mortgage transaction. For example, a Borrower with strong credit, great Income and plentiful Liquid Assets can still be declined for a Mortgage because the Collateral is insufficient or unsuitable for a Mortgage loan. Reasons for a property being unsuitable could be value, Deferred Maintenance, Functional Obsolesence, uniquity or land to value ratio (when the land is more than, for example, 30% of the Subject Property’s entire value). Usually the Site Value on the Appraisal (Cost Approach) is used to termine the percentage of value attributed to the land.

Related terms: Mortgage, Deferred Maintenance, Functional Obsolesence, Loan To Value, Appraisal, Cost Approach.

COLLATERAL PROTECTION LETTER

Document that demands that Homeowner’s Insurance be active on the mortgaged property. Collateral is such a large part of the Mortgage transaction, that if a property were destroyed by fire and there was no insurance for such an event, the only asset the Lender holds (being the property itself) would be lost. Therefore, if at any time the Homeowner’s Insurance is discontinued, the Lender will send the Borrower a Collateral Protection Letter as soon as the Lender learns of the collateral threat created by not having Homeowner’s Insurance. If the Borrower ignores the Collateral Protection Letter and does not re-establish the Homeowner’s Insurance on the property, the Lender will Force Place a very expensive Homowner’s Insurance premium and the Borrower will pay for it in an increased monthly payment. For those Borrowers who have Waived Escrows, it is important to note that the Homeowner’s Insurance company still sends an annual Declarations Page to the Lender and notifies the Lender if the Homeowner’s Insurance policy is out of force.

Related terms: Mortgage, Collateral, Hazard Insurance, Force Place.

COMBINATION MORTGAGE

See Combo Loan.

COMBINED LOAN TO VALUE

The sum of all Mortgages (or proposed Mortgages) on the Subject Property divided by the Appraised Value of the Subject Property on a Refinance or the lower of the Purchase Price or the Appraised Value on a Purchase. This is also referred to as Total Loan To Value. A property being Refinanced has a First Mortgage of $200,000 and a Second Mortgage of $50,000. This house Appraises for $300,000. The Loan To Value is 67% and the Combined Loan To Value is a little higher than 83%. See the HomeStart Specialty Tutorials, “How and Why To Do a Combo Loan”, “Do-It-Yourself Mortgage”, and one of the six called, “Tailor the Mortgage Yourself and Save Thousands - “.

Related terms: Mortgage, Loan To Value, Combo Loan, Appraised Value, Purchase Price, First Mortgage, Second Mortgage.

COMBO LOAN

The origination of two Mortgages, instead of one, to achieve the same amount of loan as a single Lien. See the HomeStart Specialty Tutorials, “How and Why To Do a Combo Loan”, “Do-It-Yourself Mortgage” and “Tailor the Mortgage Yourself and Save Thousands - “.

Related terms: First Mortgage, Second Mortgage, Combined Loan To Value, Loan To Value, Appraised Value, Refinance, Purchase.

COMMERCIAL REAL ESTATE

Commercial properties are where people work or businesses do business.

Related terms: Residential Real Estate, Industrial Real Estate, Farm & Land, Zoning.

COMMISSION

A financial incentive given to an owner or an employee of a company usually based directly upon sales or performance. Commissions are Qualifying Income provided they are averaged over the past two years and that they are likely to continue. Commissions paid in the current year or guaranteed (but not yet paid) do not count as Qualifying Income.

Related terms: Income, Gross Income, Net Income, Income Analysis, W2, 1099, Qualifying Income.

COMMISSION/SALARY

Compensation type. This type of compensation is when an employee receives a “base” Salary in addition to Commission compensation.

Related terms: Bonus, Salary, W2, 1099, Income, Gross Income, Net Income, Qualifying Income, Income Analysis.

COMP

Comparable property. A Comp used to determine Fair Market Value must generally have been sold in the last six months and must be of similar size and quality. Additionally, it should be within a mile of the subject property, preferably in the same subdivision. In situations where Comps are difficult to locate, one parameter can be stretched in exchange for the betterment of another. For example, if there are suitable properties two miles away that closed in the last two months, it is generally acceptable to increase distance in order to get a Comp of similar size and quality. In the case of rural properties, the distance of a Comp is generally the most flexible attribute of the Appraisal. The Sales Comparison Approach to an Appraisal uses Comps (or Sales Comps) to determine the Fair Market Value of the Subject Property.

Related terms: Appraisal, Appraise, Sales Comparison Approach, Sales Comps.

COMPENSATING FACTORS

Positive Mortgage file characteristics that can be used to offset negative Mortgage file characteristics. For example, a Borrower who will be experiencing high Payment Shock (a negative loan characteristic) might also have a larger than normal Down Payment. In this example the Down Payment would be a Compensating Factor. Compensating Factors include, but are not limited to: Down Payment size, low Debt To Income Ratios, low Loan To Value, large number of Liquid Assets, Negative Payment Shock, years on the job, a pending raise, or good Credit Scores.

Related terms: Payment Shock, Negative Payment Shock, Down Payment, Debt To Income Ratios, Loan To Value, Liquid Assets.

CONCESSION PLACEMENT

The placement of Seller Concessions on pg. 1 of the HUD-1 Settlement Statement or pg. 3 of the Closing Disclosure (received at Closing) instead of breaking Seller paid Closing Costs out into the Seller column.

Related terms: Closing Disclosure, HUD-1 Settlement Statement, Seller Contributions, Seller Concessions, Seller, Buyer, Purchase, Purchase Price.

CONDO

Condominium. A Condo is one unit of a complex of units that make up a building. Condos do not have ownership of the land beneath them. Usually, Condos have monthly Homeowner’s Association (HOA) dues to collectively perform maintenance, upkeep and other requirements of the complex. Condos generally do not have Homeowner’s Insurance except for policies covering the personal contents of the owner.

Condominiums (in the Conventional side of lending) are either Warrantable or Non-Warrantable. Warrantable Condos have preferred Interest Rates while Non-Warrantable Condos have higher Rates and fewer Lenders that will lend on them.